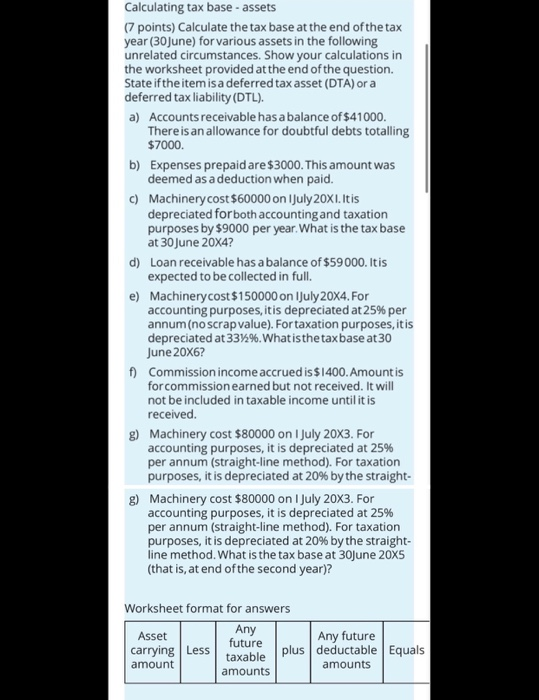

IAS 12 income taxes F7 - Nice note - IAS 12 Income Taxes Current year Future impact Results in In - Studocu

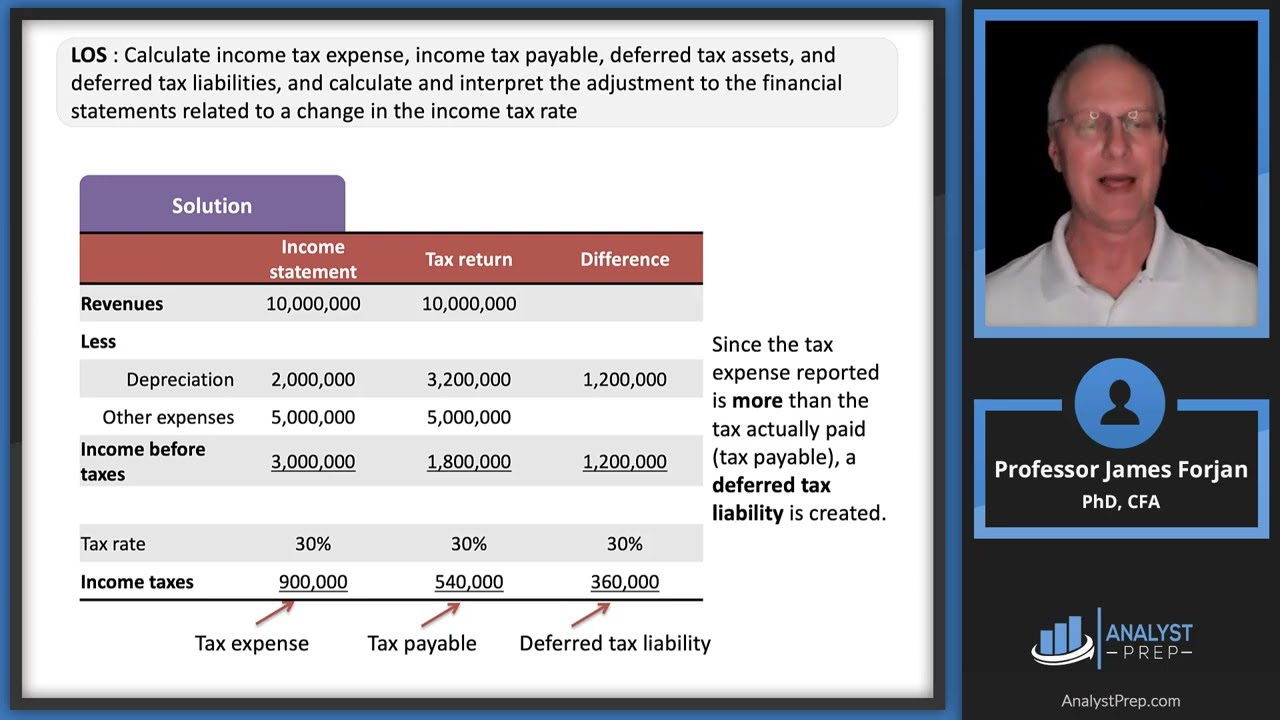

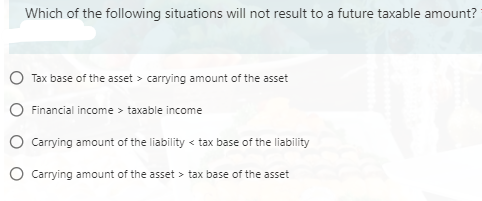

Year 1 Asset/liability Carrying amount Tax base Temporary difference Deferred tax (SFP) Income tax (SOCI) Inventory R90 000 R

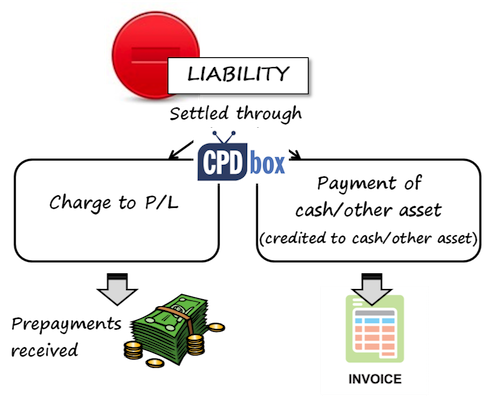

Cacique Accounting College - Today's topic - ACCA P2 - Corporate Reporting - Deferred Tax…😊 A Deferred Tax liability is an account on a company's Balance Sheet that is a result of

:max_bytes(150000):strip_icc()/TermDefinitions_DeferredTax_V1-7bcdb89b942c43268debeb7043178732.jpg)